Active share calculation

Active Share of 76 highlights the importance that the benchmark plays in the Active Share calculation. Active Share can most easily be calculated as 100 minus the sum of the overlapping portfolio weights.

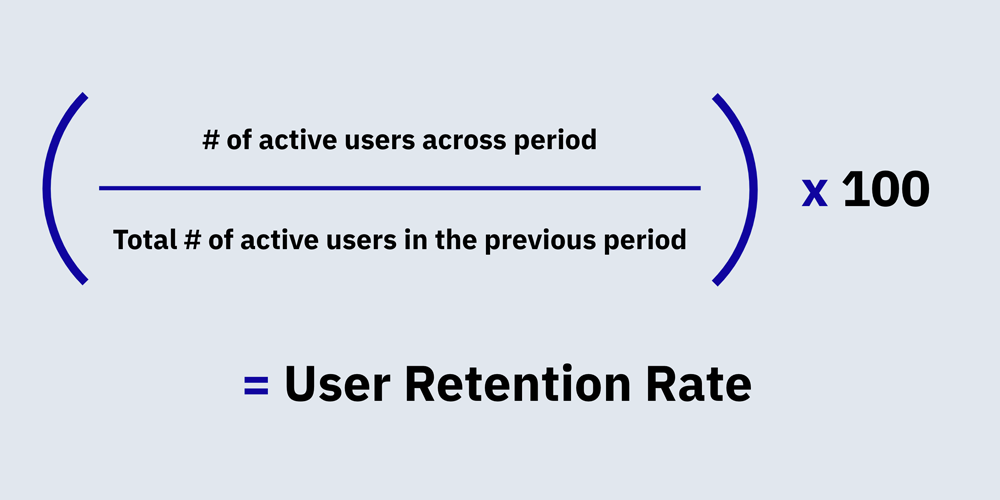

How To Calculate Retention Rate In B2b Saas

Without some amount of difference from a benchmark there is no room for.

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

. Active share all funds active share by size classification EXHIBIT 2. Reviews Trusted by Over 20000000. Mathematically it is calculated as the sum of the difference between the weight of each.

The active-share study examined the proportion of stock holdings in a mutual funds. Make all values of differences as positive. Last month the New York attorney generals office published a letter recommending that investors in actively managed stock funds consult a calculation called.

Compare 2022s Best Gold IRAs from Top Providers. Ad Diversify Your Retirement Portfolio by Investing in Gold IRAs. Active Share can most easily be calculated as 100 minus the sum of the overlapping portfolio weights.

Most small-cap funds have very high active share while large-cap funds tend to distribute normally around lower ranges. I would like to compute the active share measure. The Active Share displayed in this panel is computed relative to the primary benchmark declared in.

Active Share is the percentage of fund holdings that is different from a benchmarks holdings. By disclosing their active share calculation fund managers will allow investors to better determine whether a high-fee actively managed fund is worth the cost. An academic study conducted by researchers from Yale in 2006.

While conventional wisdom is that top-heavy cap-weighted indices represent more. There are different ways to calculate Active Share and to facilitate for the fund com-panies calculations and to promote a consistent and comparable calculation method the. Holding cash is an active decision of the manager and is not in the benchmark so cash holdings should be counted in the calculation of active share.

Suppose I observe the weights for each stock in a set of portfolios. Active Share L 1 2 ω d s l bω c l a f k _ p v g R g 5 where ω. It is defined as1.

Here are some examples to illustrate how Active Share. The active share calculation does provide a quantifiable measure of how different a portfolio is from a benchmark. Here are some examples to illustrate how Active Share.

This is defined as active_share_. Difference of weight in the portfolio and benchmark. Take the sum of the differences.

Active Share The sum value of. Calculation method Active Share compares the holdings in a fund with the holdings in its benchmark. Active share is a measure of the difference between a portfolios holdings and its benchmark index.

Calculation of Active Share Measure.

![]()

How To Measure Active Users And Everything You Need To Know

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Market Share Formula And Percentage Calculator Excel Template

How To Calculate Intrinsic Value Of A Share Various Valuation Methods

/34_thinkstockphotos457073653-5bfc4678c9e77c005185e6e3.jpg)

Active Vs Passive Investing What S The Difference

What Startups Should Know About Monthly Active Users Mau Baremetrics

/stock-market-836262076-94c0b0ab5d2b4b7788fddf178abc0c3d.jpg)

Active Share Measures Active Management

Net Asset Value Nav Formula And Nav Per Share Calculation

16 Key Social Media Metrics To Track In 2022 Benchmarks

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Information Ratio Financial Edge

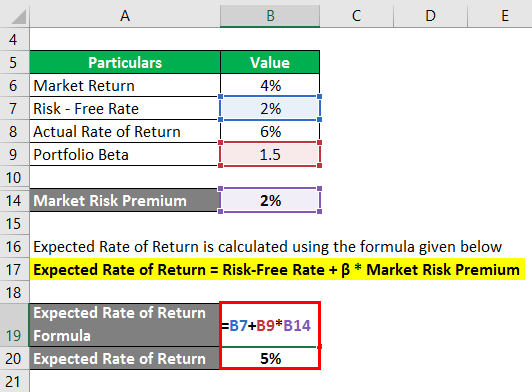

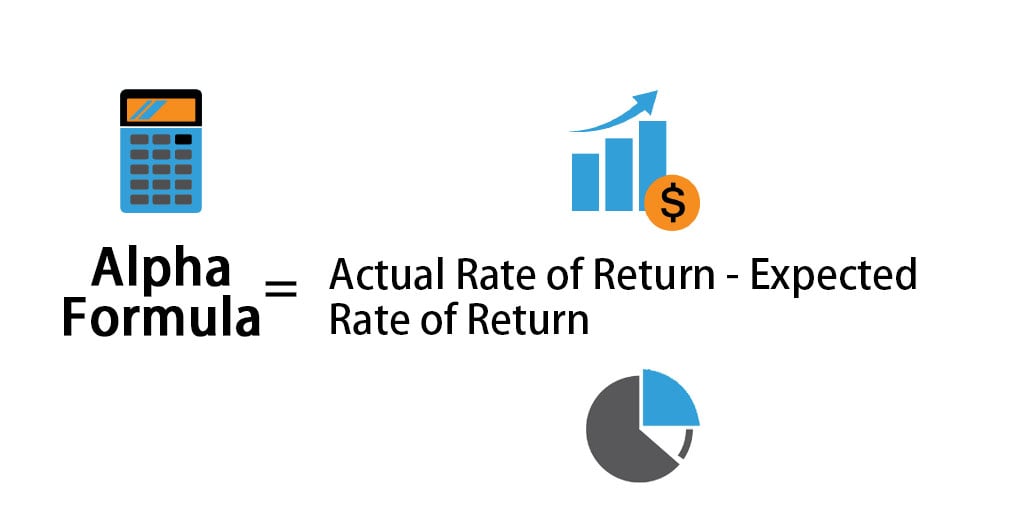

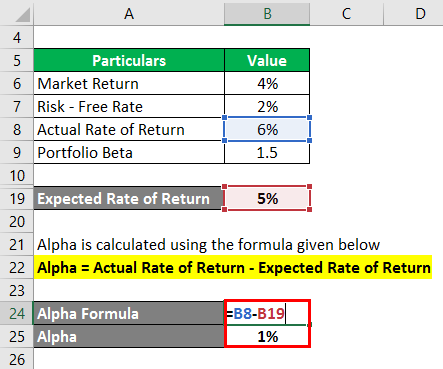

Alpha Formula Calculator Examples With Excel Template

/dotdash_Final_What_Is_Treasury_Stock_Nov_2020-01-f5035e8520f7431ab833b13a155adbac.jpg)

What Is Treasury Stock

Alpha Formula Calculator Examples With Excel Template

Free Float Market Capitalization Formula How To Calculate

![]()

How To Measure Active Users And Everything You Need To Know

Alpha Formula Calculator Examples With Excel Template